|

| The Edge FD Top Pick 2017 |

Genting Malaysia Bhd has been touted as a darling of the gaming industry for 2017 on expectations that the Genting Integrated Tourism Plan (GITP) will boost its earnings and improve market sentiment due to the legalisation of casino operations in Japan.

Research houses have pointed to expected higher visitor growth as the main catalyst for the stock in light of the full launch of the first phase of the GITP by end-2017, which includes the opening of the 20th Century Fox theme park.

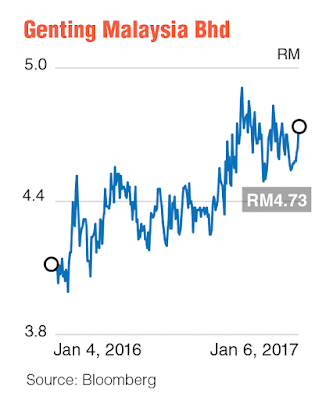

The consensus 12-month target price for Genting Malaysia is RM5.13 based on estimates by 17 out of 23 investors. The stock was last traded at RM4.73, edging up from its 2017 opening price of RM4.58. Fourteen analysts have placed a “buy” call on the stock, while seven have recommended to “hold”.

According to consensus estimates by Bloomberg, the group is expected to see a growth in its earnings per share by 13.2% for its financial year ending Dec 31, 2017. Revenue is also expected to post growth of 9.35% and 9.3% by end-2017 and end-2018 respectively.

In the current quarter, the group is expected to complete the launches of Sky Avenue and Sky Plaza, which have been fully tenanted at premium rental rates of RM20 per sq ft, according to Maybank Kim Eng’s strategy report dated Dec 19.

The weaker ringgit is also expected to be a pull factor for Chinese tourists, whose arrivals had been trending upwards by 26% in the cumulative first eight months of 2016, Maybank Kim Eng said. — By Samantha Ho

Source: http://www.theedgemarkets.com/my/article/top-10-stock-picks-2017

No comments:

Post a Comment